The 3-Minute Rule for Personal Loans Canada

Wiki Article

More About Personal Loans Canada

Table of ContentsThe Buzz on Personal Loans CanadaThe 8-Minute Rule for Personal Loans Canada8 Simple Techniques For Personal Loans CanadaThe smart Trick of Personal Loans Canada That Nobody is DiscussingSome Known Factual Statements About Personal Loans Canada

This suggests you've given every dollar a job to do. placing you back in the motorist's seat of your financeswhere you belong. Doing a regular spending plan will certainly provide you the confidence you need to handle your money efficiently. Good ideas involve those who wait.Conserving up for the large points means you're not going right into debt for them. And you aren't paying a lot more in the future because of all that rate of interest. Trust fund us, you'll appreciate that family cruise or play ground set for the children way more understanding it's already spent for (rather than paying on them till they're off to university).

Nothing beats peace of mind (without debt of course)! You do not have to turn to individual financings and financial debt when points get tight. You can be totally free of financial obligation and start making real traction with your money.

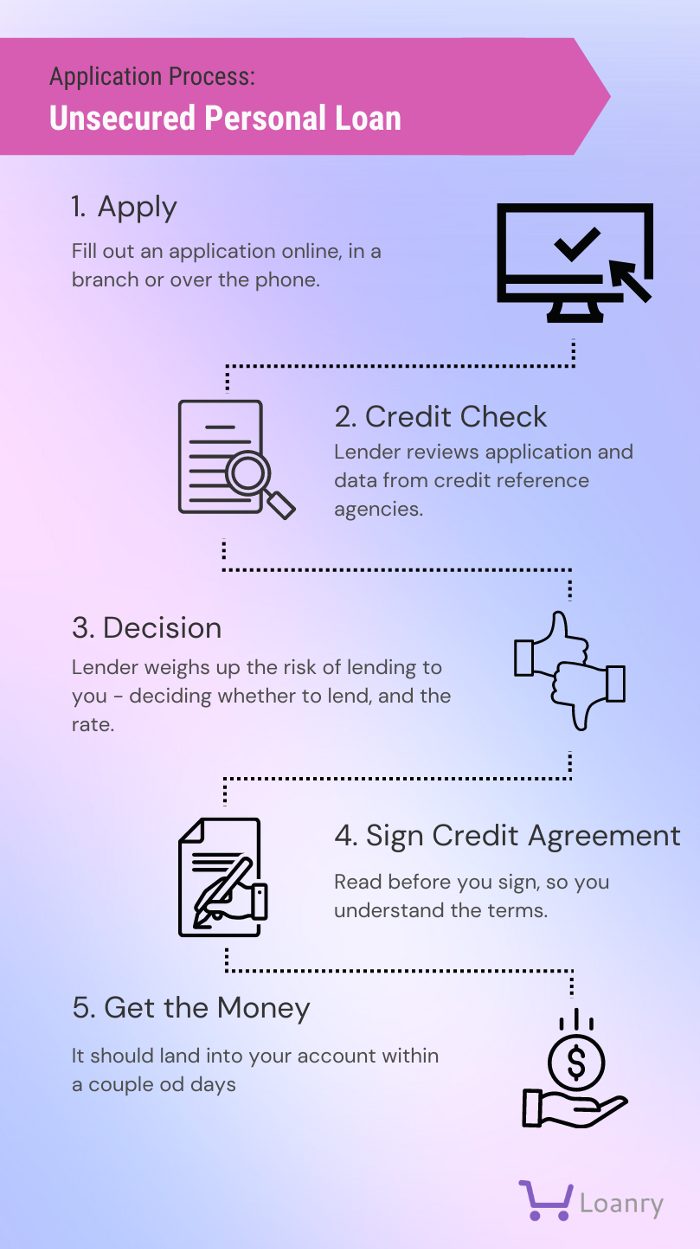

An individual funding is not a line of credit rating, as in, it is not revolving financing. When you're accepted for a personal lending, your lender offers you the full amount all at once and after that, normally, within a month, you begin settlement.

Not known Details About Personal Loans Canada

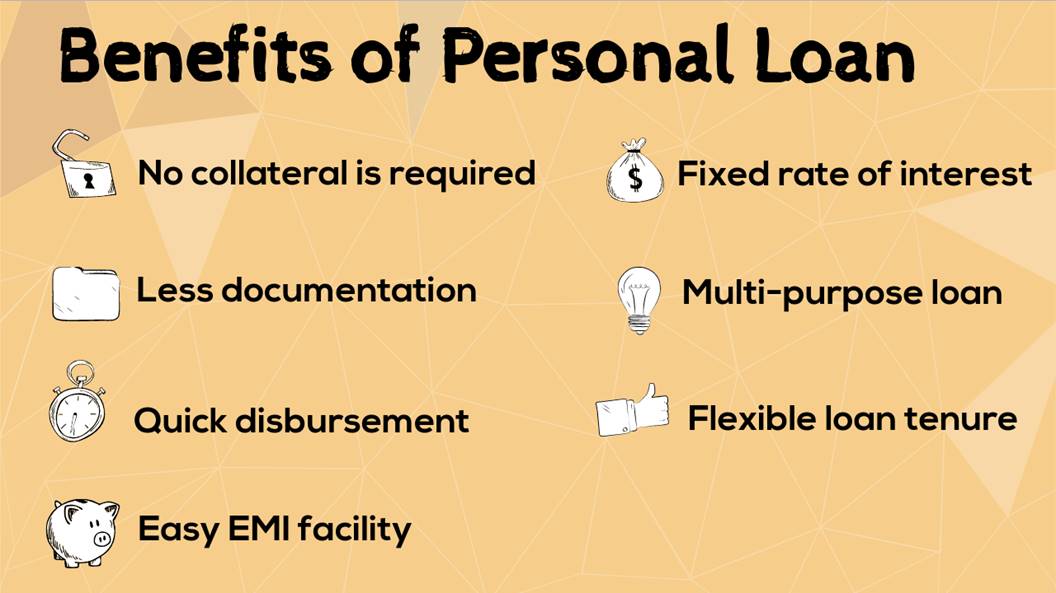

A typical factor is to combine and combine debt and pay every one of them off simultaneously with a personal loan. Some financial institutions put specifications on what you can use the funds for, however many do not (they'll still ask on the application). home enhancement finances and renovation financings, fundings for moving expenses, holiday loans, wedding event financings, medical fundings, auto repair work finances, loans for lease, little vehicle loan, funeral financings, or various other bill payments in general.At Spring, you can apply regardless! The need for individual lendings is rising among Canadians curious about escaping the cycle of payday advance, consolidating their financial obligation, and restoring their credit history rating. If you're applying for a personal finance, right here are some things you should bear in mind. Individual car loans have a fixed term, which implies that you know when the debt has actually to be settled and just how much your payment is every month.

About Personal Loans Canada

In addition, you may be able to reduce just how much overall interest you pay, which means even more money can be conserved. Individual fundings are powerful tools for developing your credit history. Repayment history make up i was reading this 35% of your credit report, so the longer you make regular repayments on schedule the extra you will see your score increase.Individual car loans give an excellent possibility for you to rebuild your credit history and pay off financial obligation, yet if you don't spending plan correctly, you might dig yourself into an also deeper hole. Missing out on one of your regular monthly settlements can have a negative impact on your credit score yet missing a number of can be ruining.

Be prepared to make each and every single payment promptly. It holds true that a personal finance can be used for anything and it's simpler to obtain authorized than it ever before remained in the past. However if you don't have an immediate need the additional money, it could not be the best solution for you.

The dealt with monthly settlement amount on a personal funding relies on how much you're borrowing, the rates of interest, and the fixed term. Personal Loans Canada. Your interest rate will depend upon elements like your debt rating and revenue. Often times, personal lending rates are a lot less than charge discover this info here card, however sometimes they can be greater

How Personal Loans Canada can Save You Time, Stress, and Money.

The market is wonderful for online-only lending institutions loan providers in Canada. Benefits include wonderful rates of interest, unbelievably quick processing and financing times & the anonymity you might want. Not every person suches as walking into a bank to ask for money, so if this is a difficult place for you, or you just do not have time, checking out online lending institutions like Spring is a terrific choice.That mainly depends on your ability to pay off the quantity & advantages and disadvantages exist for both. Settlement lengths for personal loans typically drop within 9, 12, 24, 36, 48, or 60 months. Occasionally longer settlement durations are an alternative, though rare. Shorter payment times have really high month-to-month payments however after that it mores than promptly and you don't shed more cash to passion.

Personal Loans Canada for Beginners

Your rate of interest can be linked to your settlement duration as well. You may get a reduced rate of interest if you fund read this article the lending over a shorter period. A personal term funding features a concurred upon settlement timetable and a fixed or drifting rate of interest rate. With a floating rates of interest, the passion quantity you pay will certainly vary month to month based on market changes.Report this wiki page